Socso Contribution Table For Foreign Worker 2020

Malaysian Permanent Resident under 60 years old Employee.

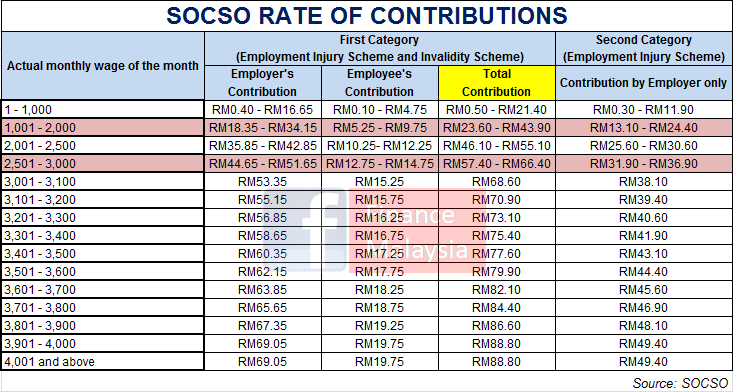

Socso contribution table for foreign worker 2020. MYFutureJobs Employer Portal User Guide. Foreign workers are covered under Act 4 while self-employed. Employers are required to contribute 125 percent of an employees monthly wages to SOCSO on a monthly basis subject to the insured wage ceiling of MYR 4000 per month and capped at MYR 4940.

Malaysia 2020 Budget How Do The Wage Hiring Incentive Work Of Economics Other Findings. Its now easier to make payments to Socso via online banking. Malaysiakini Employers Must Make Socso Contributions For Foreign Workers.

32021 13 April 2021. When wages exceed RM70 but not RM100. A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act.

When wages exceed RM30 but not RM50. Beginning Jan 1 2019 employers must make Socso contributions for their foreign workers and this involves the 18 million foreign workers that we have in the country however employers will be. Wages between RM 100 and RM 140.

Employers who hire foreign workers will be strictly monitored to ensure that their foreign workers would also be protected under the Social Security Organisation Socso. 2019 to Jan 1 2020. 2019 Socso For Foreign Worker Explain Sql Account Estream Hq.

The maximum eligible monthly salary for SOCSO contribution is capped at RM4000. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity. Wages between RM 70 and RM 100.