How To Continue Sss Contribution For Ofw

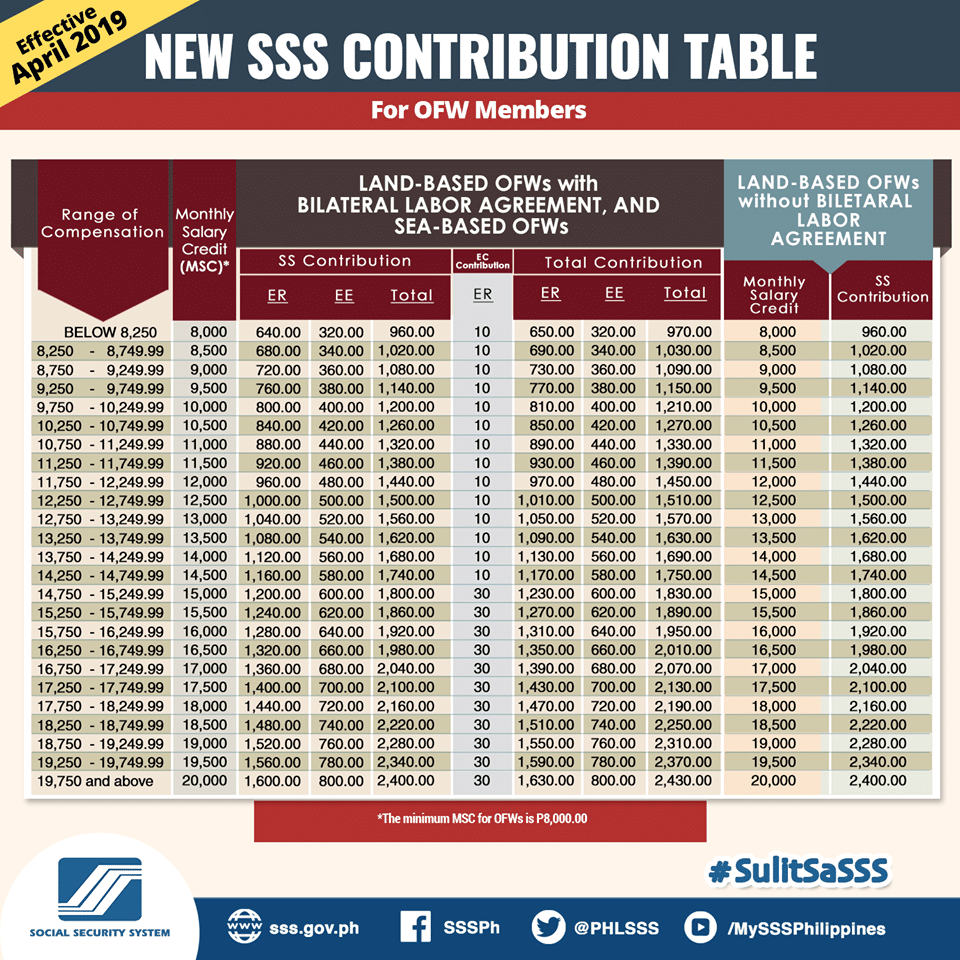

The maximum voluntary amount that an OFW can contribute is at P1760 more or less S5000.

How to continue sss contribution for ofw. Whether youre a self-employed or an OFW-member your SSS contribution rate is 11 of your monthly salary credit which is based on the monthly income you declared when you updated your SSS membership records. Just make sure the representative is using your correct SS Number and check the OFW option in the SSS payment form. This is usually means a one-time bank run where you will update the bank staff about this.

The Contributions Payment Return Form RS-5 is used by a voluntary or self-employed SSS member to pay his or her contribution. How to pay SSS Contribution online. Heres what you need to do to continue your SSS contribution.

Request for a copy of your SSS contributions the SSS online inquiry can display only 20 years of contributions and then compute your retirement benefit according to the SSS formula using your actual contributions and salary credits and then compute using a projected or additional monthly contributions and salary credits. Guide How to Check your SSS Contribution. Covered members are entitled to social security benefits upon illness unemployment childbirthmiscarriage disability retirement or death.

All employees self-employed individuals non-working spouse and OFWs up to age 60 with an existing SSS number can pay their SSS contribution to begin or continue their coverage. OFWs SSS Payments can be continued as a Voluntary Member and can choose an affordable monthly contribution. Last option is when you visit the Philippines during your holiday you may visit your bank SSS branch payment centres etc.

You may also ask a representative like a family member or a relative in the Philippines who can pay your SSS contributions on your behalf. Once logged in look for the E-SERVICE and click Inquiry. Come and join in my membership.

OFW Step by step Tesha EK - YouTube. SSS online registration guide and steps to check SSS contributions and membership data records online in 2021 for voluntary members self-employed OFW and private sector employees. The minimum compensation range for OFW contribution is 8250 which has premium payment set to 1040.